Tax season stress is real. But your clients shouldn’t feel it.

If you’re drowning in emails, missing follow-ups, or taking way too long to get back to people, not only will they be frustrated —they’ll just start looking for another firm.

That’s exactly why One CPA firm made a simple but powerful change: MESA implemented a ticketing system that ensures every client gets a response within one business day—no matter how busy things get.

We talked to their Head of Operations to find out their approach to rolling this out - here's how you can set one up too.

Step 1 : Map Out Who Answers What

First things first—who’s handling client inquiries?

Most accounting firms operate with random chaos. A client emails a CPA directly, that CPA is buried in tax returns, and… silence.

Instead - Mesa assigns clear ownership of responses. That could mean:

✅ Admin handles general questions

✅ Senior accountants take tax strategy inquiries

✅ Bookkeepers handle transaction issues

Whatever works for your firm, make it clear who owns what.

Step 2: Set Up a Central Email + Ticketing System

No more scattered emails. No more clients slipping through the cracks. Realistically you need one system to manage all your inquires in.

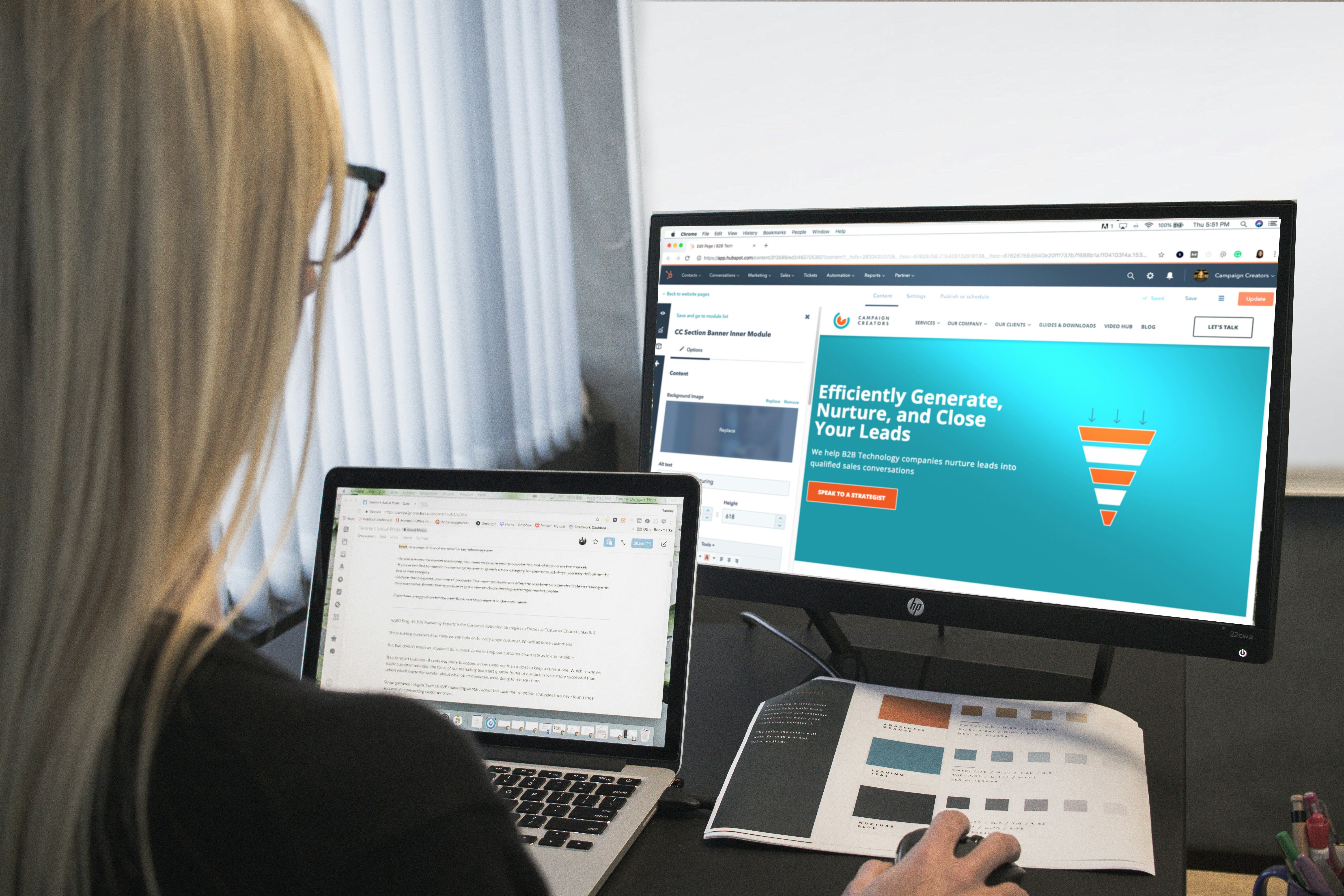

Our firms use HubSpot (but you can use whatever system works for you). The basics are:

1️⃣ Create a central email (e.g., support@[yourfirm].com)

2️⃣ Hook it up to a ticketing system so every client request turns into a trackable task

3️⃣ Automatically assign tickets based on the type of inquiry

This means no more forgotten emails—everything is logged, tracked, and resolved.

Step 3: Create Workflows to Notify Your Team

Your busy, your teams busy, no ones really holding each other accountable. Workflows in a ticketing system can do that for you.

Mesa set up automated workflows to:

⚡ Notify the right team member when a new inquiry comes in

⚡ Send reminders if an email hasn’t been answered within your response window

⚡ Escalate urgent tickets if they need immediate attention

Nothing gets lost, and no client waits too long.

Step 4: Categorize & Prioritize Client Inquiries

Not every email is urgent—but some are. That’s why it helps to create categories & priority levels.

For example:

📌 Category: Tax Questions → Assigned to Senior CPAs

📌 Category: Bookkeeping Issues → Sent to the Bookkeeping Team

📌 Category: Payment or Billing Questions → Routed to Admin

Within these, you can also set priority levels:

🔥 Urgent: Needs a response today

✅ Normal: Respond within 24 hours

📅 Low: Can be handled within 48 hours

This way, your team always knows what to tackle first.

Step 5: Automate Client Feedback

Want to know if your new system is actually working? Ask your clients.

A simple automated survey after each resolved ticket helps you gauge:

✔️ How satisfied clients are with response times

✔️ If they feel their issue was handled properly

✔️ What you can improve

Gather feedback, tweak your system, and keep refining until client response times are rock-solid.

Step 6: Start Small, Then Scale

Don’t try to roll this out to every client at once—that’s a recipe for overwhelm.

Instead, start with a small group of clients, see how it works, and optimize before expanding.

What happens when you get this right?

✔️ Your team works more efficiently

✔️ Clients get answers fast (which = happier, stickier clients)

✔️ Your firm becomes known for exceptional service—not just during tax season, but year-round

Once you've got the hang of the new system - you can optimize these key metrics even further:

- ⏱️ Average response time.

- ✅ Ticket resolution rate.

- 🌟 Client satisfaction scores.

The Bottom Line

A great client experience shouldn’t disappear during tax season.

By implementing a ticketing system, setting clear roles, and prioritizing response times, you can deliver fast, consistent service—even when you’re slammed with work.

.png)